ShareASale is one of the best affiliate marketing network, founded in 2000. To make money from popular affiliate networks like ShareASale; first thing always comes as a primary requirement is to fill out their affiliate tax form. Submitting tax form is the only way for the government to ensure that you’re paying taxes.

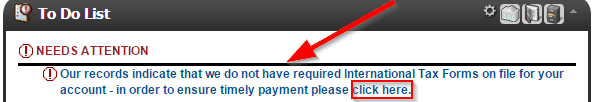

However, if you’re new to ShareASale and receiving a message saying-

“Our records indicate that we do not have required International Tax Forms on file for your account – in order to ensure timely payment please click here.”

That means, you can’t receive payments from your affiliates until you fill out their tax form. Though, It’s not as difficult as it seems.

In order to receive payments from ShareASale, you need to declare your status, in accordance with U.S. tax law and IRS regulations.

If you haven’t joined ShareASale affiliate program yet, then you can refer to my affiliate link-

«a href=“https://www.shareasale.com/r.cfm?b=44&u=1021840&m=47&urllink=&afftrack=" target="_blank”>Join ShareASale>

Why not? ShareASale is definitely one of the highest paying affiliate network in the world.

Types of ShareASale Tax Forms:

There are three types of tax forms,fill them according to your citizenship.

- W-9 Form – If you’re a US citizen.

- W-8ECI Form – If you’re a Non-US citizen but your income is connected with US.

- W-9 Form (Non-US Type) – If you’re a Non-US citizen and don’t live or work in United States.

In my case, I was eligible for W-9 (Non-US Type) form, as I live in India and my income is not effectively connected with United States. If you also live in India or other country and your income is not connected with US in any other way then you can fill out Non-US type W-9 form.

How to Submit ShareASale Non-US Tax Form:

Submitting ShareASale Non-Us tax form is quite easy. Once you’re logged into your Affiliate home, you’ll find a notification on your To Do List as shown in screenshot. Click on the notification.

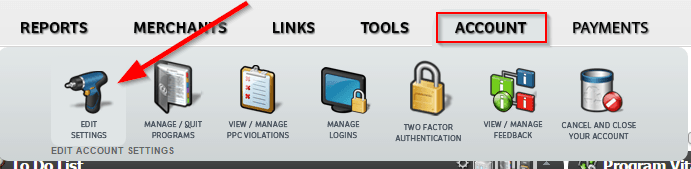

Alternatively, you can go to Account>Edit Settings, and at the very end of the page, you’ll find Tax details of your account. You’ll see the same notification, click on it to proceed.

After landing to next page, you’ll see some guidelines given related to all three tax forms. Read the first point, which is related to Non-US citizens, just click on the line saying “Non-USA Certification Form”. (As shown in screenshot)

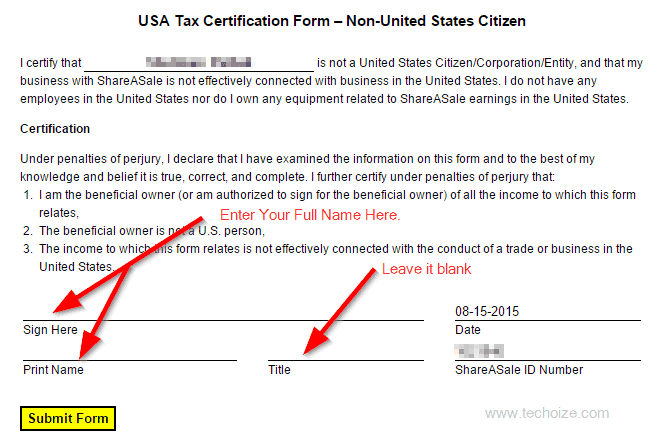

I’ll will pop up a form titled as “USA Tax Certification Form – Non-United States Citizen”, where your name, date and ShareASale ID number is already filled.

All you’ve to do is, fill your Full Name in both Sign Here & Print Name text boxes. Leave Title as blank or simply write “Owner” if you’re an individual.

Click on the Submit Form button. You’ll receive a message saying: “Thank you, your form has been received.”

![]()

Wait for their verification process to complete and you’ll be able to cash-out your ShareASale payments afterwards.

So, This is all about filling out ShareASale Non-US Tax form. If you haven’t joined ShareASale affiliate network yet, then click on the button below to become part of ShareASale network and start making money. (Contains my affiliate link.)

Let me know in comments if this guide helped you or not. Don’t forget to subscribe to my blog.